How To Apply For Student Finance 2023/24

Wondering how to apply for student finance for the 2023/24 academic year? Here's our step-by-step guide...

Are you set to go to university this year and wondering how to apply for student finance for the 2023/2024 academic year?

If you’re looking for the ultimate step-by-step guide to applying for student finance in England, we’ve got you.

Whether you’ve got an unconditional offer to study at your chosen university or you’re waiting to hear back, now is the time to begin applying for student finance - you don’t need to have received an offer to get started!

What is student finance?

Student finance is essentially a loan that you can apply for as a university student to help you financially during your studies.

Student finance is split into two loans - a tuition fee loan and a maintenance loan. The tuition fee loan covers the cost of your course and will automatically be paid to your university, whereas the maintenance loan goes directly to you and is to help with living costs such as rent, bills, groceries etc.

The amount of maintenance loan you receive depends on your personal circumstances, including whether you will be living independently or with your parents, whether you will be living inside or outside of London, and your household’s income.

Who is eligible for student finance?

Full-time undergraduate student finance eligibility

The majority of undergraduates starting university for the first time will be eligible to apply for student finance, however there are some instances where you may not be entitled.

To apply for student finance in either England, Wales, Scotland or Northern Ireland, the following must apply:

You are a UK national, Irish citizen or have 'settled status' in the UK

You must also have lived in the UK or its islands (the Channel Islands or the Isle of Man) for the three years before your course starts

You must apply to the nation where you normally live

To be eligible for student finance as a UK national applying to university in the UK, you must study a course run by a publicly funded or registered UK university or if you’re studying at a private institution, your course must be approved for public funding.

There are no age limits for tuition fee loans, however if you started your course before 1st August 2016 you must be under 60 on the first day of the first academic year of your course to be eligible for a maintenance loan.

If you’re over 60 and starting your course on or after 1st August 2016, you may be eligible for a Special Support Loan.

EU/EEA nationals who have come to the UK to study can only apply for student finance in certain circumstances - you can find out more about EU/EEA nationals’ eligibility for student finance here.

Part-time student finance eligibility

If you are a part-time student, your eligibility for student finance depends on your ‘course intensity’. This needs to be a minimum of 25%, where you study roughly 30 credits a year. In terms of the tuition fee loan, part-time students are entitled to up to £6,935 each academic year, whereas full-time students are entitled to up to £9,250.

Part-time students may also be entitled to the maintenance loan, however the amount you receive will again depend on your course intensity, where you will be living while studying and your household income.

Postgraduate student finance eligibility

If you are a postgraduate student, your student finance eligibility depends on the regulations in the nation you’re studying.

In England, from August 2022 you can get a loan of up to £11,836 to study a full master's degree - but this is intended to cover both tuition fee costs and living costs.

As you can imagine, this often isn’t enough with some master’s courses costing more than the entire master’s loan. This means you’ll have to fund the rest yourself.

In Scotland, the total postgraduate loan you’re entitled to is £10,000.

In Northern Ireland, this is £5,500 and does not cover living costs, only tuition fee costs.

In Wales, from August 2022 you can get up to £18,430 for postgraduate study, which is actually the most generous loan on offer for postgrads in the UK.

How to apply for student finance 2023

Once you’ve determined whether you’re eligible to apply for student finance, you can head over to Student Finance England to register for an account and begin your application. You can also apply by post if you’d prefer but the easiest and quickest way to apply is online.

The application process itself should take less than 30 minutes, so you don’t have to set a lot of time aside to get your application ready to go!

Most importantly, you don’t need to wait for an offer from your chosen university to apply for student finance. You can simply apply using your preferred choice and you can change your uni, college or course details when you receive your A-Level results. So don’t wait for UCAS offers to come through before applying - the sooner you apply, the sooner you can begin budgeting.

Here is a step-by-step guide on how to apply for student finance for the 2023/2024 academic year…

Step 1: Make sure you have the information you need to proceed with your student finance application

Before you begin your application, you’ll want to make sure you have the following information to hand:

Passport

National Insurance number

Bank details

If you’re applying for support with living costs (the maintenance loan), you’ll also likely need the following information from your parents/guardians so that Student Finance England can assess your household income:

Earnings for the previous tax years (2021/22 if you're applying to study in 2023/24)

You may be required to submit further evidence of this, perhaps in the form of a P60.

Step 2: Set up an online account

Before you begin, you’ll need to register for an account with Student Finance England. This should only take a couple of minutes, you’ll just essentially need to create a login.

Step 3: Provide the required information

You’ll be prompted for the relevant information needed to assess your student finance application, including your personal details and proof of identity such as your UK passport details or a copy of your birth certificate if your passport has expired.

As mentioned above, you’ll also need to submit details about your household income if you’re applying for a maintenance loan.

Student Finance England will reach out to the people in your household to confirm their income and may ask for further evidence.

Household income always includes income you get from your own savings, investments or property and may also include your parents or partner’s income depending on your circumstances.

For those under the age of 25 who financially depend on at least one parent, your household income will include:

Your parents’ income, if you live with them or depend on them financially

The combined income of one of your parents and their partner, if you live with them or depend on them financially

For those over the age of 25, your household income will include:

Your partner’s income if you live with them

Your parents’ income will not be considered, as you will be classed as an ‘independent student’.

Step 4: Submit your application but be sure to update your details if necessary

Once you have completed the student finance application, you can simply wait for Student Finance England to process your application unless your circumstances change.

You must update your application if this is the case, for example if you change where you’re going to be living during your studies. You can do this by logging into your online account.

Other changes you must report to Student Finance England include:

You’ve changed your course, university or college

You’re repeating a year

You’ve changed your name or marital status

Your Tuition Fee Loan amount has changed

You’re living somewhere new

Step 5: Use a student finance calculator to estimate your loan entitlement

While you’re waiting for your student finance application to be processed, you can use the UK government’s student finance calculator to give you a rough estimate of how much you will be entitled to.

This can be a useful way to begin budgeting and taking into account how much maintenance loan you may be left with after rent, bills and general living costs.

When does student finance open 2023 and what is the deadline for the 2023/24 academic year?

Student finance applications for full-time undergraduates are now open, meaning you should start thinking about applying as soon as possible if you haven’t already.

Part-time undergraduate applications for 2023 to 2024 are expected to open from June 2023.

The deadline for full-time undergraduates applying for student finance for the first time is 19th May 2023. It can take up to six weeks to process your application.

How to reapply for student finance

If you’re a continuing student (i.e. you’re not in your first year of study), you should reapply for student finance by 23rd June 2023 for the 2023/24 academic year.

The process of reapplying is very similar to the process of applying for the first time, however you must update Student Finance England with any changes to your circumstances.

If you're in your final year of study, it's important to note that you will receive less than usual because SLC (Student Loans Company) stops paying you after the last day of term. You should take this into account when budgeting for your final term.

How much student loan will I get?

As mentioned, how much student loan you receive depends on your personal circumstances. But here are the general guidelines for full-time undergraduate students:

Tuition Fee Loan entitlement

With regards to your tuition fee loan entitlement, this depends on how much your course fees are, but you can receive up to £9,250 per academic year to cover these costs. This loan will go directly to your university/academic institution.

Maintenance Loan entitlement

Your maintenance loan entitlement depends on your household income, whether you will be living independently or with your parents and whether you will be living inside or outside of London.

The maximum maintenance loan in England for the 2023/24 academic year is up to £8,400 if you're living with your parents during term time or up to £9,978 if you're living away from home outside London or £13,022 if you're living away from home in London.

When is student finance paid?

If you're currently at university, you can find the 2022/2023 maintenance loan payment dates here. The 2023/24 maintenance loan payment dates have not yet been confirmed however they tend to fall around the same time every year at the beginning of each term. Your maintenance loan payments are split into three instalments to coincide with the three university terms.

This means you can expect to receive your first student loan instalment when your course commences (late September/October), your second instalment in January, and your final instalment at the beginning of April.

How can I save money as a student?

If you're beginning to think about how to budget during your time at university, you may be wondering how to save as much money as possible - particularly if your maintenance loan does not cover your living costs.

You may need a part-time job or a side hustle to help financially, but there are also other ways you can make your money go further as a student.

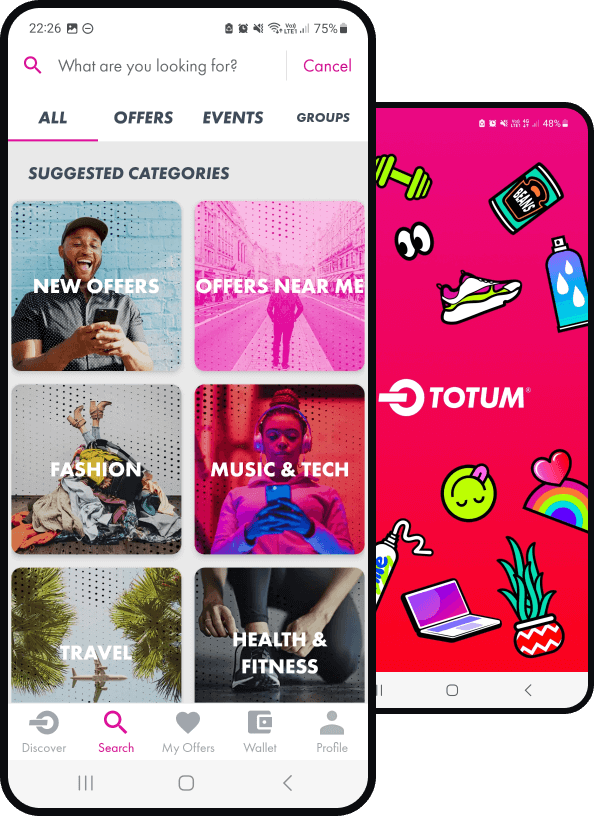

Students in the UK are entitled to exclusive student discounts, and as a TOTUM member you'll get access to the best student deals, discounts and offers with hundreds of leading brands.

Whether it's saving on your weekly grocery shop with TOTUM Cashback or on study essentials such as a new laptop with Apple, you can bag the best bargains with your TOTUM membership.

Check out our other top student money-saving tips below:

HOW TO SAVE UP TO £85 ON YOUR MONTHLY BILLS AND ESSENTIALS WITH TOTUM

LOAN DROP 2023: HOW TO MAKE YOUR NEXT STUDENT LOAN PAYMENT GO FURTHER

Join the TOTUM club!

Join TOTUM Student for FREE to access hundreds of student discounts on big-name brands like ASOS, Apple, MyProtein, boohoo, Samsung, and more!

Sign up for FREE, download the TOTUM app, and enjoy the latest offers, vouchers, coupons and more at your fingertips. Find out more.

Download The TOTUM App

Stories like this

The Ultimate Student Discount Showdown: TOTUM vs. Student Beans vs. UNiDAYS – Which Is Truly the Best?

Welcome to the definitive guide on navigating the world of student discounts. If you're a student in the UK, your inbox and social media feeds are likely bombarded with offers from various platforms promising to save you money. - find out which is best!

The Apprentice Advantage: 7 Essential Ways Your TOTUM+ Card Protects Your Budget During a Second Career

Taking the leap into a second career via an apprenticeship is a courageous and brilliant move. At 30, 35, or beyond, you are bringing years of professional experience, maturity, and a clear vision to your new path - TOTUM can support you on your journey.

What the 2025 Budget Means for Students, Apprentices & Professionals

If you’re studying, working an apprenticeship, or simply trying to figure out what’s next, there are some big changes that are worth knowing about.

_(1).png%3Fw%3D500%26q%3D60&w=3840&q=75)