Do Apprentices Pay Tax?

Wondering whether apprentices pay tax? We take you through how much tax you may have to pay as an apprentice, whether you will have to pay National Insurance, and help you may be entitled to.

If you're due to start an apprenticeship and trying to figure out how much net income you'll receive each month, you may be wondering whether apprentices have to pay tax.

Apprentices typically have to pay tax and National Insurance despite the fact that they can often earn a relatively low income, however there are some exceptions to this.

We take a look at how much tax you may pay as an apprentice and what help you may be entitled to.

What is an apprenticeship?

An apprenticeship is essentially a combination of practical work, training and study for those aged 16 or over to prepare them for a specific job role. It involves a lot of on-the-job learning and will result in a qualification once completed.

There are thousands of apprenticeships available in a range of industries, from engineering and construction to project management and marketing.

If you haven't yet decided whether an apprenticeship is for you, check out our blog post on apprenticeships vs university to make an informed decision.

How much do apprentices get paid?

The amount an apprentice is paid depends on the employer but the National Minimum Wage rate for an apprentice is £5.28 per hour as of January 2024, however this is due to rise by 21% from April 2024 to £6.40 per hour.

It is illegal for an employer to pay apprentices less than this and many campaigners are fighting for better pay, arguing that low-paid apprenticeships simply aren’t viable in the current climate and that this is resulting in low uptake.

Some employers will increase an apprentice’s pay as they gain more experience and skills throughout the duration of their apprenticeship, which can take anywhere between one to four years to complete. But often an apprentice will only receive a higher rate of pay once they have completed the apprenticeship.

An apprentice salary can also depend on the level of qualification being studied: intermediate, advanced, higher or degree.

What is tax?

If you’ve never had to pay tax before, you might be wondering what it actually is.

Income tax is a payment made to the government that is automatically deducted from your salary (unless you’re self-employed). Tax helps to fund public services such as the NHS, education, the welfare system, investment in roads and housing.

When you receive your pay slip, you'll see how much income tax you have paid - this should be listed beneath the 'deductions' section along with your National Insurance contribution and any other deductions such as student loan repayments (if applicable and you're earning above the repayment threshold).

Do apprentices pay tax?

Apprentices are not exempt from paying tax, meaning you will pay tax each month in the same way that any other employee would. However, for the 2023/2024 tax year, if you earn below £12,570 per year, you will not be required to pay income tax due to this being the Personal Allowance threshold - i.e. the amount you can earn before you’ll start being taxed.

If you earn more than £12,570 per year, you’ll be taxed on everything you earn over this amount and will be assigned a personal tax code based on your income, age and other personal circumstances.

This will be determined by HMRC and your employer - all you need to do is provide the correct identification when you start your apprenticeship, such as your National Insurance number.

Do apprentices pay National Insurance?

Like income tax, National Insurance contributions are another form of tax on earnings paid by employees, the self-employed and employers.

Unlike income tax, however, you may still have to pay National Insurance contributions even if you earn below £12,570.

In the 2023/2024 tax year, those above the age of 16 earning £242.01 or more per week (£1,048.01 per month) have to pay Class 1 National Insurance contributions (NIC).

This was charged at 12% of your income between £242 and £967 per week, however from 6th January 2024, the rate of Class 1 National Insurance contributions deducted from employees’ wages was reduced from 12% to 10%.

If you earn below £242 per week but over £123 per week, you do not have to pay any Class 1 NIC however your NIC record will be 'credited', as though you have paid it.

Can I get discount as an apprentice?

If you’re currently an apprentice, you may be wondering how you can save money and reduce costs wherever possible - after all, many are struggling to get by on an apprentice wage that is lower than the living wage, especially during the cost of living crisis.

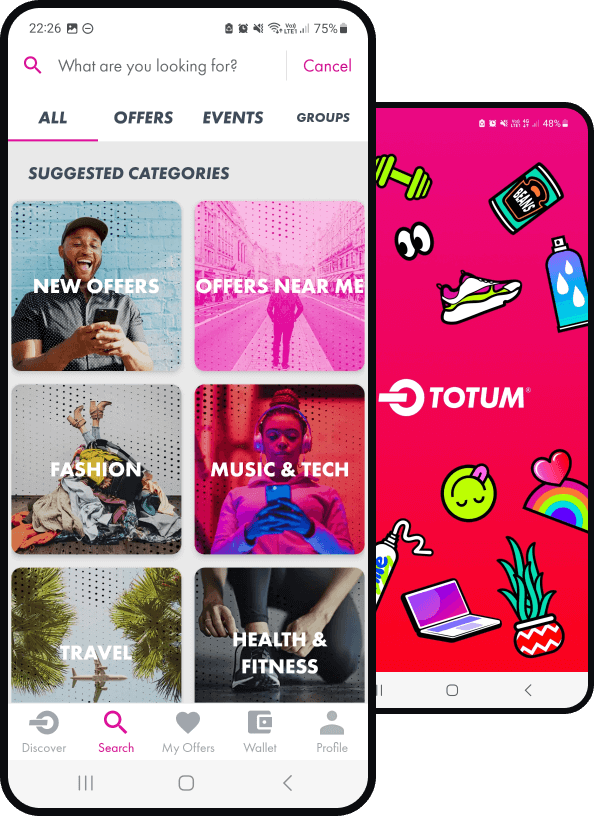

You’ll be thrilled to hear you can access exclusive apprentice discounts with TOTUM Apprentice, saving on everything from study essentials to days out, technology, travel and more.

TOTUM Apprentice is the only discount card for apprentices and can be used at hundreds of high-street stores and leading retailers such as Boots, Samsung, Amazon, ASOS and more.

Can apprentices claim benefits?

Apprentices may be eligible to claim benefits depending on your personal circumstances, such as your age and your income.

Most people under the age of 18 will not be able to apply for benefits, however if you're aged 16-18 and on a low income or meet specific eligibility criteria, you may be able to apply for Universal Credit.

Apprentices can only claim Universal Credit if they are on a recognised apprenticeship, meaning you must:

Have a named training provider

Be working towards a recognised qualification

Be paid at least the National Minimum Wage for an apprentice

Find out more about eligibility for Universal Credit here.

Join the TOTUM club!

Join TOTUM Student for FREE to access hundreds of student discounts on big-name brands like ASOS, Apple, MyProtein, boohoo, Samsung, and more!

Sign up for FREE, download the TOTUM app, and enjoy the latest offers, vouchers, coupons and more at your fingertips. Find out more.

Download The TOTUM App

Stories like this

Best Discounts For Your April 2024 Student Loan Drop

Looking for the best student discounts and offers to help your April student loan drop go further? We've got you...

Students May Soon Be Made To Pay Council Tax

A campaign calling for an end to student council tax exemptions has been launched after it was found that Durham County Council is losing £11m.

Top University Accessories 2024

Wondering which accessories to pair with your essential university laptop for both style and functionality? Check out our top picks to enhance your success!