Loan Drop 2024: How To Make Your Next Student Loan Payment Go Further

Wondering how to make your next student loan payment last all term? Here are our top budgeting tips for students...

If you’re one of the many students counting down to the next student loan drop, we’ve got some top tips to make your next student loan payment go further.

It’s always tempting to splurge on some new clothes, the latest piece of tech or a summer holiday abroad when your student loan drops, but in the current climate this simply isn’t possible for thousands of students relying solely on their student loan payments to support themselves throughout university.

This doesn’t mean you can’t still treat yourself occasionally, but there are ways of making your money go further!

When is the next student loan payment in 2024?

Students who have successfully applied for student finance can expect to receive the next maintenance loan payment at the beginning of April 2024.

This loan is provided to help with day to day costs as well as the likes of rent, utilities, grocery shopping and any other bills you may have. It is intended to support you until the following term, which means you’ll need to make each instalment last for around three months.

You can find out each of the student finance payment dates for 2024 here.

How to budget a student loan

Your maintenance loan will be split into three payments made at the start of each university term - which means you will typically receive one in late September/early October, one at the beginning of January, and one at the beginning of April to coincide with the academic year.

As mentioned above, this means you’ll be expected to make your student loan last until the next term - which means budgeting is essential.

This doesn’t have to be complicated though, and there are a number of ways that you can make your next student loan payment go further.

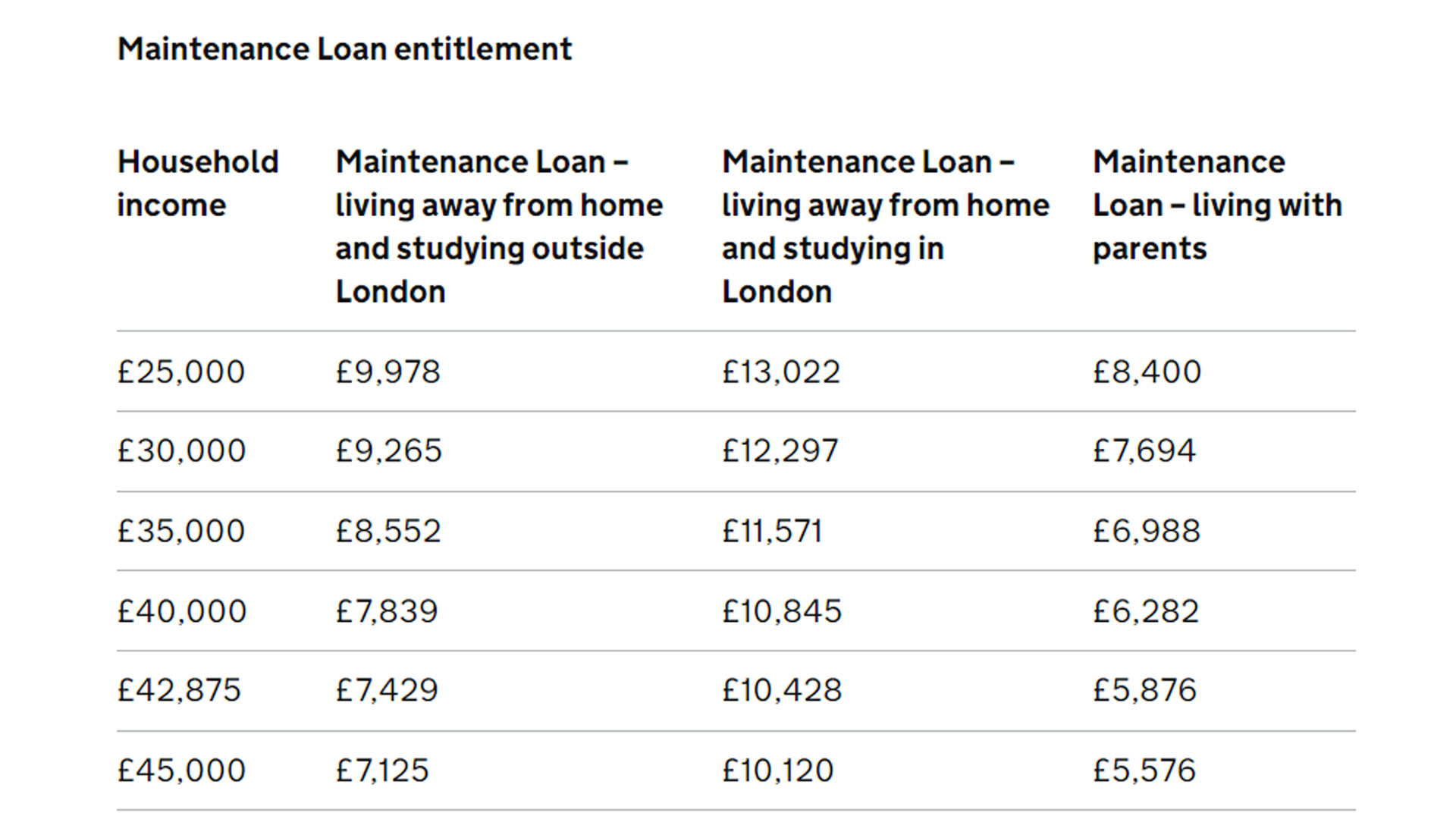

Firstly, you’ll want to establish exactly how much you’re set to receive each term - the minimum maintenance loan currently available is around £5,576 per year for students living with their parents, £7,125 per year for students living without their parents outside of London and £10,120 per year for students living without their parents in London.

The maximum maintenance loan available is £8,400 per year for students living with their parents, £9,978 per year for students living away from their parents outside of London and £13,022 per year for those living away from their parents in London.

You can check the status of your student loan payments as well as how much you will be receiving each term by logging into your student finance account at https://www.gov.uk/student-finance-register-login.

Once you’ve determined how much you’ll be receiving throughout the academic year, you should take a look at your outgoings. This will include things such as (but not limited to):

Rent payments

Utilities such as water, gas and electric (some student accommodation/landlords may include this in rent payments, but it’s important to clarify this so that you can know how much you’ll be expected to pay each month)

Weekly food shops and any other essentials you may need such as toiletries etc.

Other bills you may pay for - e.g. phone bill, gym membership, TV licence, broadband

Daily/weekly transport costs (especially if you are taking your car with you to university - you’ll definitely need to account for ongoing car insurance and fuel costs)

Course materials (e.g. textbooks, equipment)

After you’ve figured out your rough monthly expenses you should be able to work out how much of your maintenance loan you’ll have left to spend on non-essentials such as social events, hobbies, days out, new clothes and more.

How to budget as a student

So, now that you’ve figured out the amount of money you’ll have remaining each month, how can you make sure your next student loan payment stretches as far as possible?

Here are our top tips for budgeting as a student…

1. TOTUM student discount

Our number one tip is to make the most of being a student by investing in a TOTUM card, which gives you access to hundreds of the best student discounts, exclusive offers and more.

When you register as a TOTUM member, you’ll save on everything from study essentials such as textbooks and stationery to travel, fashion, beauty, days out, technology and more.

Offering over 350 discounts with huge brands such as Apple, Samsung and Amazon, you’ll make huge savings during your time at university with TOTUM.

Best of all, you'll also receive a FREE 12-month tastecard membership for each year’s TOTUM membership purchased. This means you’ll not only have access to all of TOTUM’s incredible student discounts but will also be able to take advantage of tastecard’s amazing offers too - which includes 2 for 1 dining at thousands of restaurants across the country, 50% off pizza delivery, up to 50% off days out and so much more.

Whether you’re investing in a new laptop or dining out with friends, make your money go further with TOTUM.

2. Student budgeting apps

Another great way to budget as a student is through budgeting and money management apps such as Revolut, Curve and Moneyhub.

These apps do the hard work for you by figuring out exactly how much disposable income you may have left over each month and how much you should be aiming to spend and save.

With Revolut, you can get weekly insights into your spending thanks to its categorisation features, so you’ll be able to track exactly where you spend most of your money and can potentially work on reducing this if needed. Try Revolut Premium FREE for 3 months with TOTUM.

With Curve, you can link all of your cards in one place and will get instant spending notifications, allowing you to easily keep an eye on your daily outgoings. If you sign up to Curve with TOTUM and complete a £10 transaction within 14 days, you’ll receive a £15 deposit in your account.

3. Set up automatic transaction round-ups with the likes of Monzo

With Monzo, you can easily save money using its clever transaction round-up feature.

Essentially, every time you buy something via Monzo, the app can round up the cost to the nearest pound and save the change to one of your saving pots.

This is a super simple and effective way to save when you’re tight on cash and can’t afford to set up regular weekly or monthly savings.

4. Plan ahead and prioritise meal prep

One of the best budgeting tips students can follow is to plan ahead and introduce meal prepping into your weekly schedule.

You’d be surprised just how much those takeaways and meals out can add up, and while we’re all for the occasional treat, opting to buy a supermarket meal deal every day on your way to uni rather than batch cooking your own lunches will really start to add up.

To cut back on costs, take a look at our helpful guide to student budget meals and meal prepping.

5. Earn passive income

Finally, if you’ve worked out that your student loan payments won’t quite get you through each term, you may need to consider ways to earn money - but this doesn’t necessarily mean having to get a part-time job.

You could potentially try starting your own side hustle - here are some of the best student side hustles.

6. Reduce your energy costs

Finally, with the current energy crisis, gas and electric bills are at an all time high.

But by making a few simple changes, you can begin cutting back on your energy usage.

Here are our top tips for saving energy as a student, from choosing a lower temperature setting when using your washing machine to using lamps rather than overhead lights.

Join the TOTUM club!

Join TOTUM Student for FREE to access hundreds of student discounts on big-name brands like ASOS, Apple, MyProtein, boohoo, Samsung, and more!

Sign up for FREE, download the TOTUM app, and enjoy the latest offers, vouchers, coupons and more at your fingertips. Find out more.

Download The TOTUM App

Stories like this

Maths Homework Aimed At Seven-Year-Olds Leaves Parents Baffled

A perplexed parent shared their seven-year-old's maths homework online after being left stumped by one question in particular...

Does Ikea Do Student Discount? How To Save At IKEA As A Student

Looking for an IKEA discount code for students? While IKEA doesn't offer year-round student discount, here's how you can save...

Spring IKEA Haul: How To Earn Money When You Refresh Your Home For Spring

Ready for a home refresh just in time for spring? Here are our top picks from IKEA and how you can earn money on your new home purchases...