Take Our Quiz And Find Your TOTUM Tribe!

Fancy receiving personalised offers and discounts tailored to you and your interests? Take the TOTUM Tribe quiz to find out more...

The longer you’re in one place, the itchier your feet get… Travel, meeting new people and having exciting new experiences is what The Explorers live for. Check out our Travel section for tips, discounts and all the inspo you need for your next adventure.

Explore Travel

We thought we’d count down some of our favourite holiday destinations for winter sun that might just float your proverbial boat. Here are our top five picks.

Sri Lanka has been ranked ninth by the BBC in a list of the best places to travel to this year. Here are our top picks of what to see and do on holiday in 2026.

If your knowledge of the latest releases is second to none and learning about the newest technologies, taking apart old gadgets, and exploring the digital universe are your passions, read on to find all the latest tech news, deals, discounts & more.

Explore Technology

Looking for some new earphones but not sure where to start? We discuss the best earphones available at different prices so you can keep listening no matter your budget!

The last thing you want before a big deadline is unexpected tech issues. And that’s where your student discount card can make a huge difference, from saving on a new device to a discounted upgrade.

A healthy lifestyle and looking after both your body and mind are your passions! Your spare time is taken up with gym sessions, mindfulness and healthy eating - but you'll still let loose when the opportunity arises! Welcome to the home of all things Health & Wellness.

Explore Health & Wellness

The supplement world can feel like a maze of options. That’s why we teamed up with the legends at JSHealth Vitamins to bring you these quick-fire tips so you can start strong and smart. Enjoy!

Looking for the best budget fitness watches to help you monitor your activity and kickstart your fitness journey? We've got you...

Whether it’s a big night out or hosting everyone at your house, you’re never happier than when you’re surrounded by the people you love. From making sure everyone is well-fed to organising group days out and even holidays, here's where you'll find all things Entertainment...

Explore Entertainment

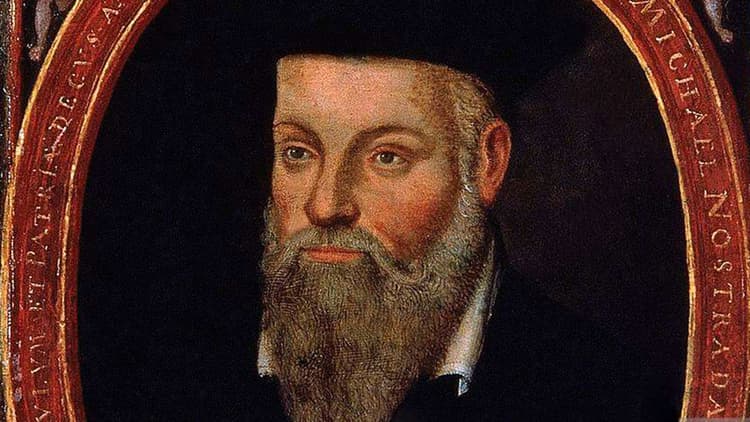

From global chaos to technological breakthroughs, here are the five that people are calling the most chilling.

From late-night Netflix binges to 9AM deadlines, Virgin Media’s M125 Student Broadband keeps you streaming, studying & scrolling without the stress.

For those who are never happier than when you’re engrossed in learning, if knowledge is your super power, if a question needs answering - from finance to cleaning hacks - if you’re the one they turn to in their hour of need, here's where you can gather all that fresh knowledge.

Explore Advice & Hacks

Wondering when you'll receive your student finance payments in 2025/26? Here's how you can find out when you'll receive your maintenance loan.

After six consecutive years at number one, London has officially been knocked off its perch.

Discover our top cashback offers for students at big UK brands like Boots, IKEA, Primark, and Sainsbury's.

If the runways of Paris and Milan are your spiritual home (but really, anywhere you can strut your stuff will more than do), shopping sprees are your therapy and your Amazon wish-list has got to be in the running for some sort of world record then this is the place for you...

Explore Fashion

Calling all thrifters! Whether you’re saving up for something big, decluttering your wardrobe, or just love a good deal, Vinted and Depop are your golden tickets to smart, sustainable fashion.

A former Senior Merchandiser at TK Maxx has revealed what shoppers should look out for when hunting for a bargain in the store...

Bringing you savings on the important things in life - from insurance, to breakdown cover to tips and advice on how to save your precious pennies...

Explore Home & Finance

Off to university this year and ready to open a student bank account but don't know where to start? Here are some of the UK banks with the best student account perks in 2025...

Turn your uni house into a home on a budget with Dunelm! Discover stylish, affordable essentials and make the most of Dunelm’s 10% student discount. From cosy bedding to space-saving storage, create a space you’ll love without breaking the bank.

Dine out for less with our great food and drink discounts both online and in-store! Whether it’s big savings on takeaway pizza, a quick bite on-the-go, or a family meal out, we’ve got you covered.

Explore Food & Drink

Here are five of our favourite recipes that are healthy, wholesome and highly budget friendly. And don’t forget to check out our student discounts, as well!

You may want to start keeping a close eye on those black coffee drinkers in your life as it turns out they may be hiding an alarming side to themselves...

Doing your best to reduce your impact on nature is at the centre of everything you do. Vintage fashion, thrifting, environmentally conscious eating, and creating as little waste as possible are always at the front of your mind.

Explore Sustainability

Whether you're sharing a student house with friends or living alone, here are our top tips to save energy as a student.

What if you could do your bit to help the environment and earn yourself a bit of money in the process?